Structured Pricing Products

Structured Pricing Products

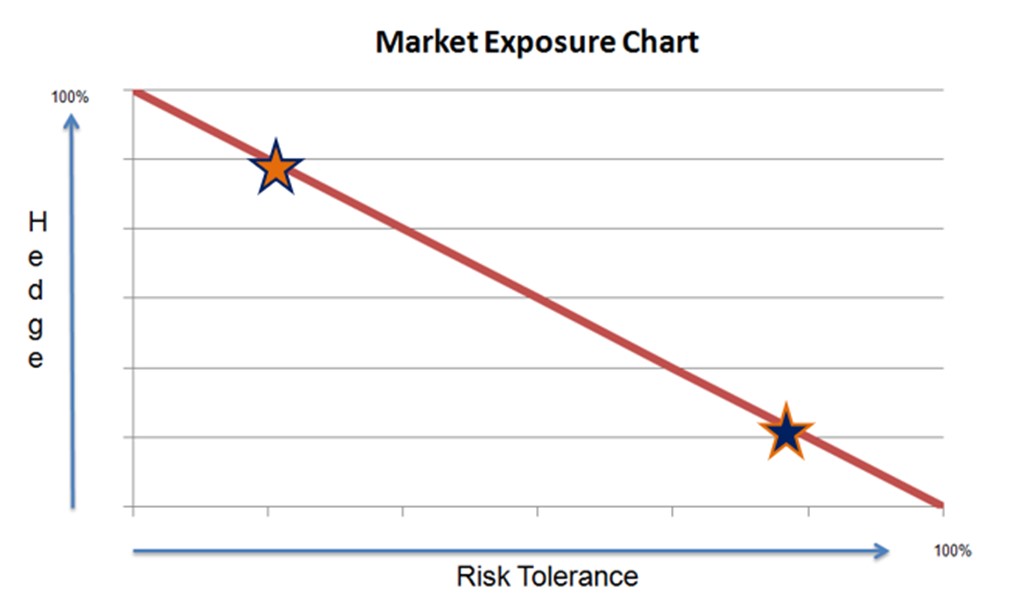

Our competitive wholesale pricing options allow you to price your supply in a manner that is consistent with your individual risk tolerance and budget objectives. With EnerStream, you can choose from full price certainty for a one-to-five-year term with our fixed price plan or opt for some market exposure via an index based and Market Tracker plans. All our programs are designed to let you mitigate your natural gas price risk appropriately and keep objectives in line with specific organizational policies.